Notice Board

ATTENTION DISABLED VETERANS

A special note to the Veterans of Clayton Township

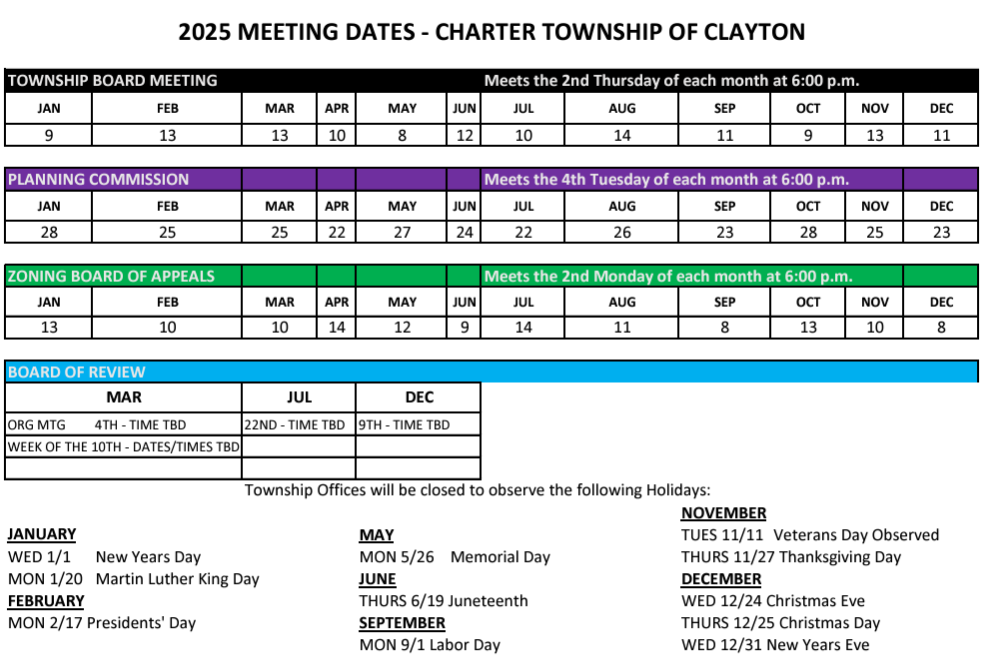

You may qualify for an exemption on your residential, Homestead Property Tax. You must apply, annually, with an application by submitting a completed Affidavit for Disabled Veterans Exemption prior to the start of the March, July, or December Board of Review meeting dates. The July Board of Review may grant the exemption if the applicant otherwise qualified for the exemption but didn’t file the affidavit and supporting documentation at the Board of Review in December. Click here to read Michigan’s Veteran’s Affidavit to see if you qualify.

Please note: Requirements, deadlines and submission information continues to be modified as the program is established. Please continue to check this website and/or the State of Michigan website for updates.

Public Service

General Information

- Need to report a street light outage? Click Here

- IT’S FLU SEASON. PROTECT YOURSELF. Be Wise Immunize

Please see the new Program offered by Genesee Health Plan:

Finding major potholes? Call Genesee Country Road Commission. Report an issue 810-767-4920